A Biased View of Offshore Business Formation

Table of ContentsOffshore Business Formation Things To Know Before You Get This10 Easy Facts About Offshore Business Formation DescribedWhat Does Offshore Business Formation Mean?9 Easy Facts About Offshore Business Formation ExplainedOffshore Business Formation for BeginnersRumored Buzz on Offshore Business FormationOffshore Business Formation Things To Know Before You BuyLittle Known Facts About Offshore Business Formation.See This Report on Offshore Business Formation

Nevertheless, if you signed up a firm in Hong Kong, its income would just be strained from 8. 25% form 16. 5%. On top of that, the income that is earned beyond Hong Kong can be entirely spared from neighborhood tax. Company titans do this at all times. Apple, Samsung, Google, Berkshire Hathaway, they all have actually developed overseas firms as their subsidiaries in many countries around the globe.

What Does Offshore Business Formation Mean?

Various other normal benefits consist of better personal privacy, property protection, ease of consolidation, as well as low-cost maintenance. Some nations enforce unbelievably high tax rates on company earnings. Example, The rates are 37. 5% in Puerto Rico, 30% in Germany, and also 25% in France That's why thousands of business owners available have actually determined to go offshore.

Tax optimization does not always suggest to escape taxes. When seeking tax solutions, you must abide with both the legislations in the bundled territory and also your house country.

8 Simple Techniques For Offshore Business Formation

If you intend for the former team, you ought to think about everything carefully. Some no-tax jurisdictions are transforming their plans quick. They are starting to enforce taxes and laws on certain type of income and company activities. And some locations have a truly negative reputation in the company globe. These are the ones you should stay clear of. offshore business formation.

In specific, banks in Singapore or Hong Kong are very concerned concerning opening an account for companies in tax obligation places. They would certainly also be concerned to do company with your firm if it is included in such territories.

The Best Guide To Offshore Business Formation

That's why detailed planning and also research study is a need to (or at least the best assessment from the real specialists). Instance Here is an instance for offshore planning: You open up a firm in the British Virgin Islands (BVI) to provide services overseas. You likewise establish your business's monitoring in one more nation to make it not a BVI-resident for tax objectives.

And also because BVI has a reasonable reputation, you can open a business financial institution account in Singapore. This will certainly permit your business to get money from clients effortlessly. If needed, you after that require to develop navigate to these guys your tax residency in one more nation where you can get your service money without being tired.

What Does Offshore Business Formation Do?

These nations typically have a network of global tax obligation treaties, which can bring you tax decrease and also exception. If you accept paying a little quantity of tax in return for respect and also stability, low-tax territories can be the right option.

This means, your properties are shielded versus the judgment made by international courts. Only the court of the unification jurisdiction can place a judgment on the possessions. If you created a count on in Belize, the trust fund's building would certainly be shielded from any insurance claim according to the regulation of another jurisdiction.

The Ultimate Guide To Offshore Business Formation

Depend on is just one of one of the most ideal vehicles for your possession security. click this link If you looking for a service lorry for asset security, look no more than. Some other typical offshore centers that supply economic personal privacy are the BVI, Seychelles, Cayman Islands, and Nevis. The offshore unification procedure is instead easy as well as fast.

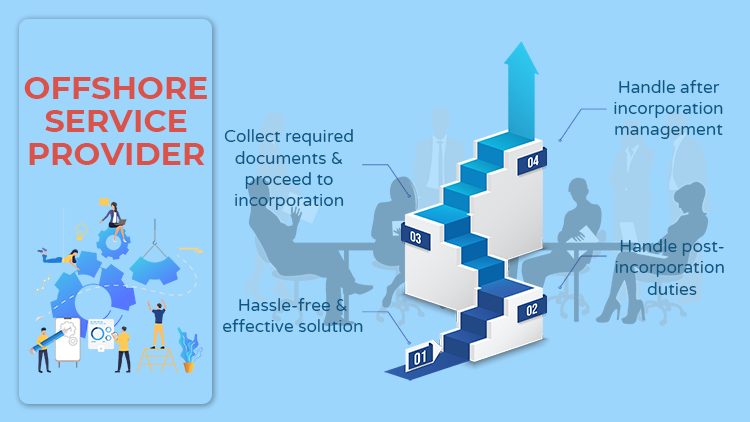

The consolidation needs are normally extremely minimal. They will certainly go on and sign up the firm on your behalf.

Everything about Offshore Business Formation

: Located in the western Caribbean Sea, this is a really common option for most foreign capitalists that are looking for tax-free benefits.: BVI and Cayman Islands share several common attributes - offshore business formation. An and also is that the consolidation expense in the BVI has a tendency to be a lot a lot more budget friendly than that in the Cayman Islands.

Here is the basic unification procedure. Please keep in mind that things may get slightly different according to various territories. There are lots of different kinds of business entities. Each type will certainly birth various key characteristics. When picking your kind of entity, you his explanation ought to think about the complying with elements: The entity lawful condition The liability of the entity The tax obligation as well as other advantages of the entity Pointer, The suggestions is to go for the sort of business that has a different lawful status.

Things about Offshore Business Formation

A separate lawful entity guarantees you a high level of security. Each territory has a different set of needs as well as consolidation process.

More About Offshore Business Formation

The reason is that foreigners do not have details tools and also accounts to sign up on their very own. Also when it is not required, you are still suggested to use a consolidation service.